Leveraging Industry 4.0 to drive ROI in the US spirits industry

The technology revolution comprizing Industry 4.0 is already impacting the alcoholic beverage sector. From smart automation in production processes, to innovation insights and marketing initiatives enabled by the Internet of Things (IoT), opportunities are extrapolating throughout the industry’s value chain. This article highlights the key areas where new Industry 4.0 capabilities can sharpen US spirits producers’ competitiveness and boost their profitability.

Jim Beam, one of the world’s oldest liquor brands, was born during the first Industrial Revolution. Just over 200 years later, the world has entered a fourth wave of disruptive technological change. Production processes, and all related business sectors, from manufacturing to services and retail – and throughout their supply networks – are being impacted by Industry 4.0. The US alcoholic beverage industry is no exception — Industry 4.0 is transforming the way the sector produces, markets, transacts and reports.

Spirits distillers, in particular, are soaring

The US spirits market grew 4.7% to $81.3 billion in 2018, the largest value growth in a decade, and the ninth consecutive year of share gains for spirits within the overall US alcoholic beverage sector. Five core technologies – the engines of industry 4.0 – are driving the remodeling of business and industry, and opening frontiers of opportunity for US spirits producers:

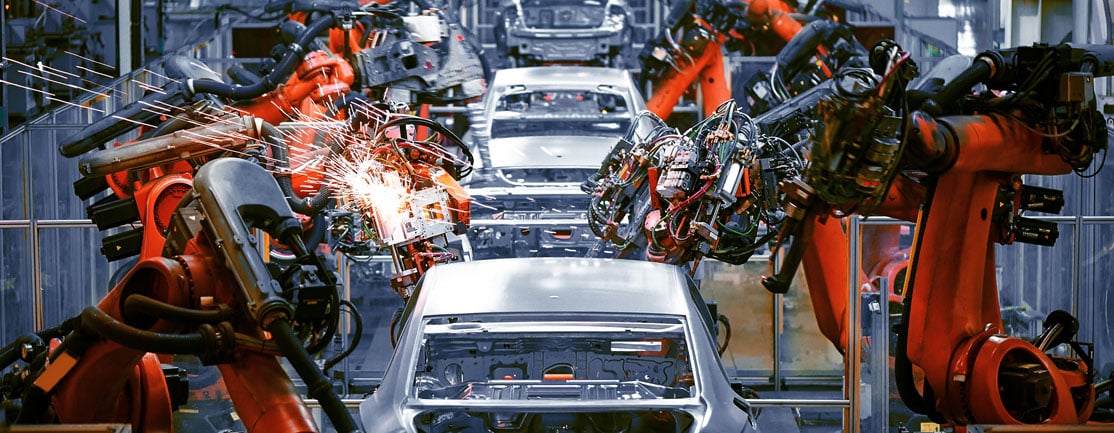

- Robotics are increasing the degree of process automation, re-gearing the pace of production and the mode of manufacturing

- Big data capabilities facilitate massive informational volumes and flows, and new capacities to mine for insights and opportunities within the data

- Artificial Intelligence (AI) is broadening the scope of algorithms towards predictive analytics, incorporating iterative, real-time machine learning

- The hyper-connectivity of the Internet of Things (IoT) interlinks networks of connected computers and digital sensors within these systems, allowing seamless integration of even fragmented or remote facilities

- Cloud storage solutions permit the collation and sharing of vast data banks and analytics programes, creating the ability to manage a globalized operational and value chain footprint using systems such as Vendor Managed Inventories (VMI) and methodologies such as blockchain

Alcoholic beverage companies, and their products’ power and profitability, depend upon brand attraction and the agility and efficiency of their value networks. From the distillery or brewery, to the mass production facility, through the network’s route-to-market, key questions revolve around how Industry 4.0 opens up or fine-tunes opportunities for liquor companies to better innovate, produce, market and sell.

For US spirits producers, where are the clear ROI benefits of Industry 4.0 to address crucial issues?

1. Plant productivity and resource management

Production can be enhanced in multiple ways. Automation improves process speeds and KPI

achievement. Collaborative robots (COBOTS) on bottling and packing lines and in warehouses not only speed up processes, but also alleviate ergonomically onerous tasks previously assigned to operators, improving safety as well as productivity.

Drone technology is being used to monitor agricultural crop inventories and their security (see related article, ‘Beam Suntory Mexico flies high with drone mapping improvement project’).

Analytics and IoT infrastructure are generating improved and centralized information, enabling integrated visibility across the entire value chain. Ingredient input efficiencies can be refined, and quality control improved. Issues such as wastewater treatment, tracking and tracing of raw materials and finished inventories, and rapid delivery – both to retailers and on-consumptions – can all be optimized through digitization.

Production processes can be rapidly changed to reconfigure for new formulations or formats, special runs, or seasonality. Digital solutions can accommodate small batch runs to cater for test flavors or a customized market demand. Quicker time-to-market can be achieved; rapid label redesigns are feasible; technologies can scan brownfield plant systems into a digital twin, enabling simulations (rather than costly real time) tests on production runs.

Predictive maintenance is an inherent by-product of IoT technologies. Embedded equipment sensors – for temperatures, torque, or vibrations – can transmit signals, usually to a data cloud. Master mainframes then interpret the data to predict failure timelines, and proactively prevent them. Machine learning improves as the data points expand and the algorithms adapt for further information and data points. These systems and analytics achieve enhanced Supply Chain Risk Management (SCRM) insights, building resilience into the company’s plant and production facilities.

Perhaps most importantly, harnessing better and more detailed information forges optimal decisions. Digital solutions and customized software will answer feasibility questions involving projected segment sizes, simulate production run alternatives, model cost variations for formulation differences, or clarify implications for labelling, warehousing or distribution costs. Robust decision-making, and the operational excellence and agility it engenders throughout the supply chain, is a formidable characteristic of the application of Industry 4.0 technology tools. .

2. Formulations and techniques

Bourbon, Tennessee whiskey, rye and tequila all have centuries-old recipes. But, for the US’s giant producers as well as boutique distilleries, technologies have exponentially advanced production processes.

Using bespoke IoT equipment sensors, variables regarding temperature, air and water flows, barrel pressures, humidity – and dozens of others – are now monitored and analyzed for effect on flavor. Countless permutations of adjustments are now achievable through automation, and the effects can be monitored in real time. As data point collection escalates, so the degree of expertise increases, and the level of experimentation can be heightened.

Although, ultimately, technology can’t replace time: premium spirits still require ageing – for bourbon, at least 20 years.

3. Innovation

The surge of experimentation and repertoire drinking among US consumers requires producers to be on the cutting edge of trends. Innovation is an industry driver. Predicting and then riding the wave of a consumption trend – or, prompting one – is about timing. Consider flavored bourbon: a decade ago the category was non-existent, but today it’s a substantial new segment, and a category driver among Millennials. Exotic gins are an even more recent example of premiumization or novelty as a prerequisite for competitiveness and market share among adventurous drinkers in the Instagram age.

Digital platforms and applications, especially social media, are a vital route to discover and gauge food and drink fashions. Tools to capture data – in-store activity, consumer metrics, portfolio sales trends – and analyze these, rapidly and predictively, adds dimension to the sales and marketing function’s agility in reacting to and capitalizing upon consumer trends, adjusting the structure of brand portfolios, and aligning resources accordingly.

4. Marketing

Alcoholic drinks categories proliferate with choice. IoT applications can break through the blur by prompting and rewarding consumers at various consideration and buying stages. For instance, Beam Suntory created a custom-made consumer app, The Cocktail Project, loaded onto tablets and made available to shoppers in proximity to mixed-case displays. Consumers could use the tablet or scan barcodes to obtain cocktail recipes using specific Beam Suntory brands at key points of the purchase decision.

Fast-forward to the future: drinks designed by algorithms. Intelligens AI:01 is the world’s first whisky made by AI. Swedish distiller Mackmyra partnered with Finnish technology company, Fourkind, using advanced machine learning to analyze the myriad range of inputs into creating a blended whisky. Over 70 million data points were analyzed – across drinker preferences, ingredient combinations, sales trends, and maturation options – to configure an algorithmically-designed, ‘optimized’ and unique blend. “Generated by AI, curated by people”, is how Mackmyra describes their new product. It’s been closely followed by a gin, Monker’s Garkel, launched by UK distillery Circumstance Gin, who used AI to analyze thousands of herbal and botanical combinations and recipes, and derive an appropriate gin name.

Increasingly, consumers want to know more about a drink’s ingredients and its provenance. IoT makes it possible for consumers to understand the product’s journey through the supply chain – an affirmation of authenticity which strengthens brand values. Digitally connected, intelligent packaging or labelling can activate communication between consumers and brand producers. Through QR codes or tags, packaging becomes an interactive and informational channel, transforming packaging beyond the purely functional.

Consumers today expect this type of intuitive, interactive, customized purchasing experience from brands, a fusion of online retail and offline shopping pleasure. Convenience, together with an information-rich and on-demand buying facility, will become retail table-stakes in many categories, especially for premium products. In terms of fulfilment, too, a one-hour, personalized delivery may be part of an app’s functionality and service – and drones will increasingly be used to fulfil the order.

Every digital interaction also provides manufacturers the opportunity to collect and collate consumer data. Obtaining and understanding target market consumer behavioral patterns is a fundamental strategic and competitive advantage for alcoholic beverage makers: demographic information, purchase locations, brand likes on social media – these are ripe for data mining. Industry 4.0 provides powerful means and tools to do this. Algorithms and analytics can predict buying and market trends, and glean consumer insights.

Currently, online sales comprise only 1% of alcoholic beverage purchases in the US. But the industry must imagine and embrace a future of disrupted retail, one of staff-less outlets, digital wallets, consumer choice prompted by algorithms, and fulfilled by autonomous solutions.

5. Brand protection

Within ever more complex and dispersed supply and distribution networks, and across a progressively more volatile business landscape, global brands – representing the primary asset value of many alcoholic beverage companies – need safeguarding.

Traceability is a supply chain imperative. To achieve regulatory compliance, Industry 4.0 digital applications assist in mitigating risks around product composition, package tampering, and distribution and sales policy adherence.

Cloud platforms, in combination with technologies such as radio frequency identification (RFID) tags, enable product tracking from source ingredients to end-consumer, serving to minimize counterfeiting risks, thereby protecting brand trust and loyalty associations.

The acceptance and take-up of blockchain encryption methodologies will further enhance the industry’s value network protocols. Blockchain has the potential to achieve holistic, irrevocable and transparent recording of all transactions, from producers to wholesalers, onwards to retailers, and through to on-consumption outlets and consumers.

In the state of Kentucky alone, there are some 7.5 million barrels of bourbon quietly ageing in warehouses. IoT sensors monitor their contents’ ageing; RFID tags to help track each of these; automation facilitates smooth stacking and loading; and enterprise network solutions enable the final bottled products to be visible as they are distributed and sold across the retail chain. At the heart of these seamless systems is the combination of Industry 4.0 technologies and applications.

Conclusion

Primarily, Industry 4.0 requires a forward-thinking, proactive approach to investment in new technologies, and embracing a strategic shift in the company’s business model and culture. Payback should quickly be earned across all crucial aspects of the alcoholic beverage company’s operations, driving ROI in a virtuous circle of data-driven intelligence and innovations, operational efficiencies and productivity improvement, and profitability.

Change – especially technology-driven change – is exponential. Precisely how the dramatic flux of Industry 4.0 may transform the US spirits sector is impossible to predict. But producers and distillers who seize the opportunities and initiatives presented by 4.0 will be those whose brands are still in existence 200 years from now.